Couldn't find this product!

Sign In / Sign Up

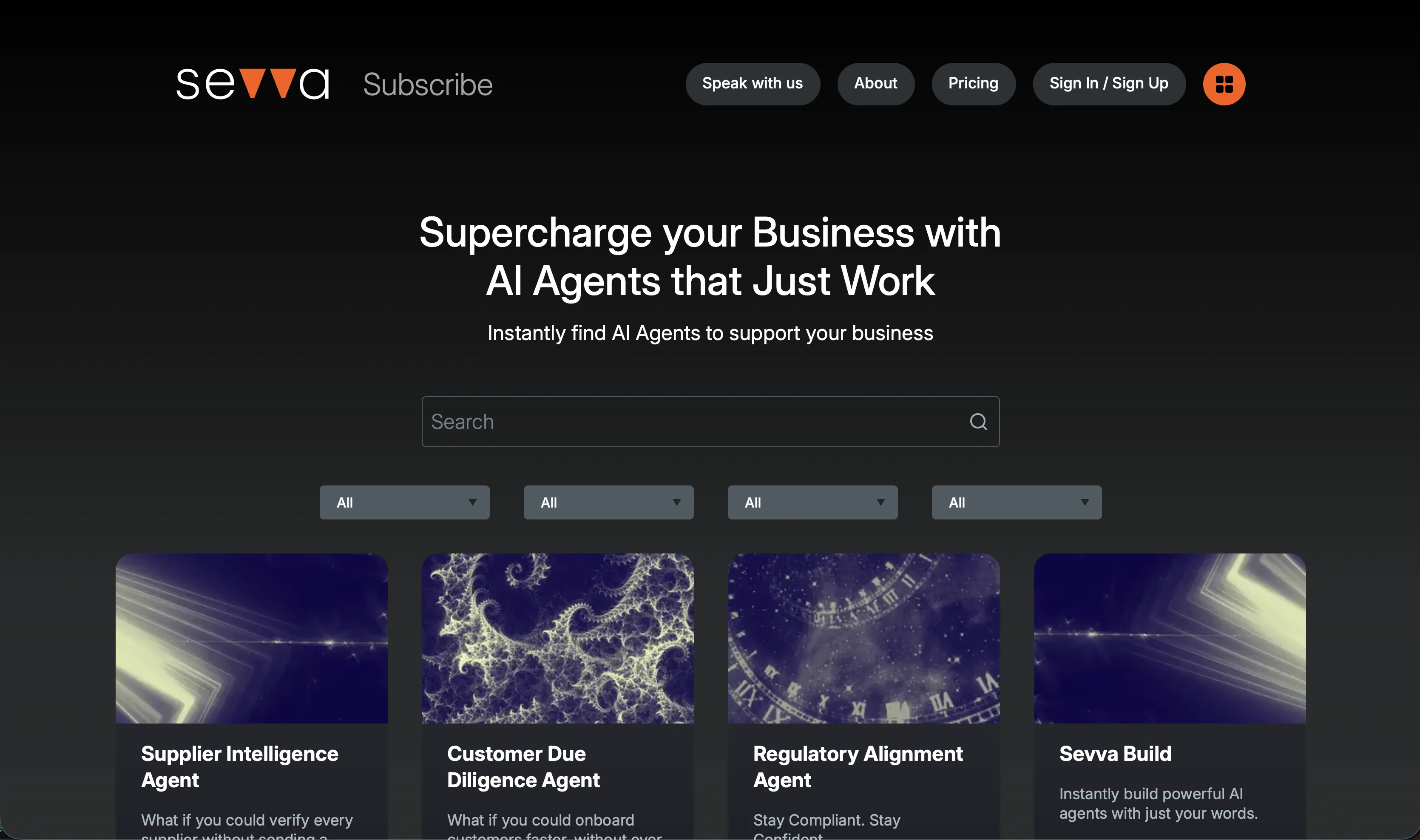

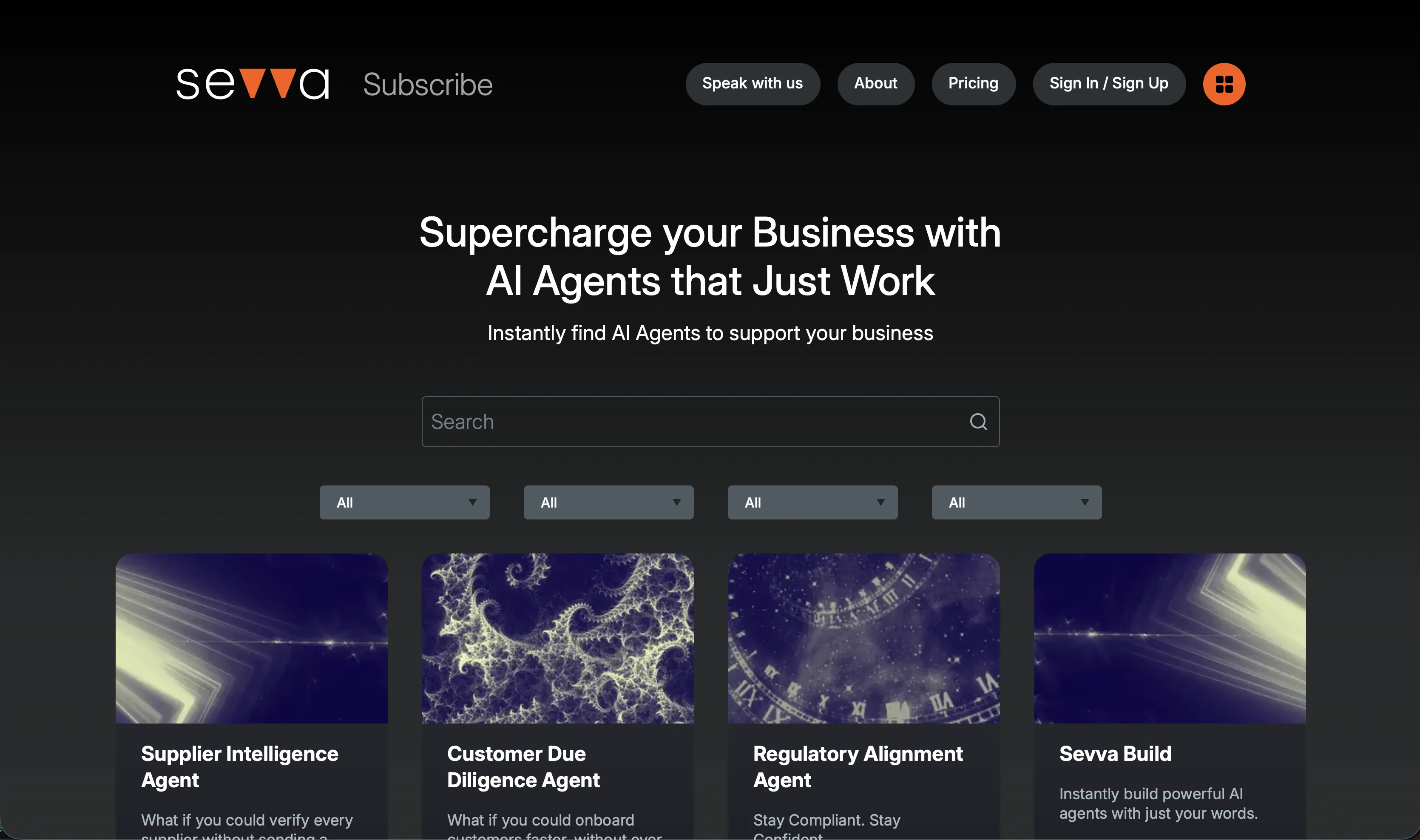

AI Agent Hub

Sevva AI Agent HubSupercharge your business with State-of-the-Art Generative AIs. Instantly subscribe to Generative AIs now to empower your business.

Portfolio AI Solutions

Sevva Portfolio AI SolutionsSupercharge your business with State-of-the-Art Generative AIs. Instantly subscribe to Generative AIs now to empower your business.

News

NewsLatest news and blog posts.

Sevva Platform

Sevva PlatformAccess the Sevva Platform

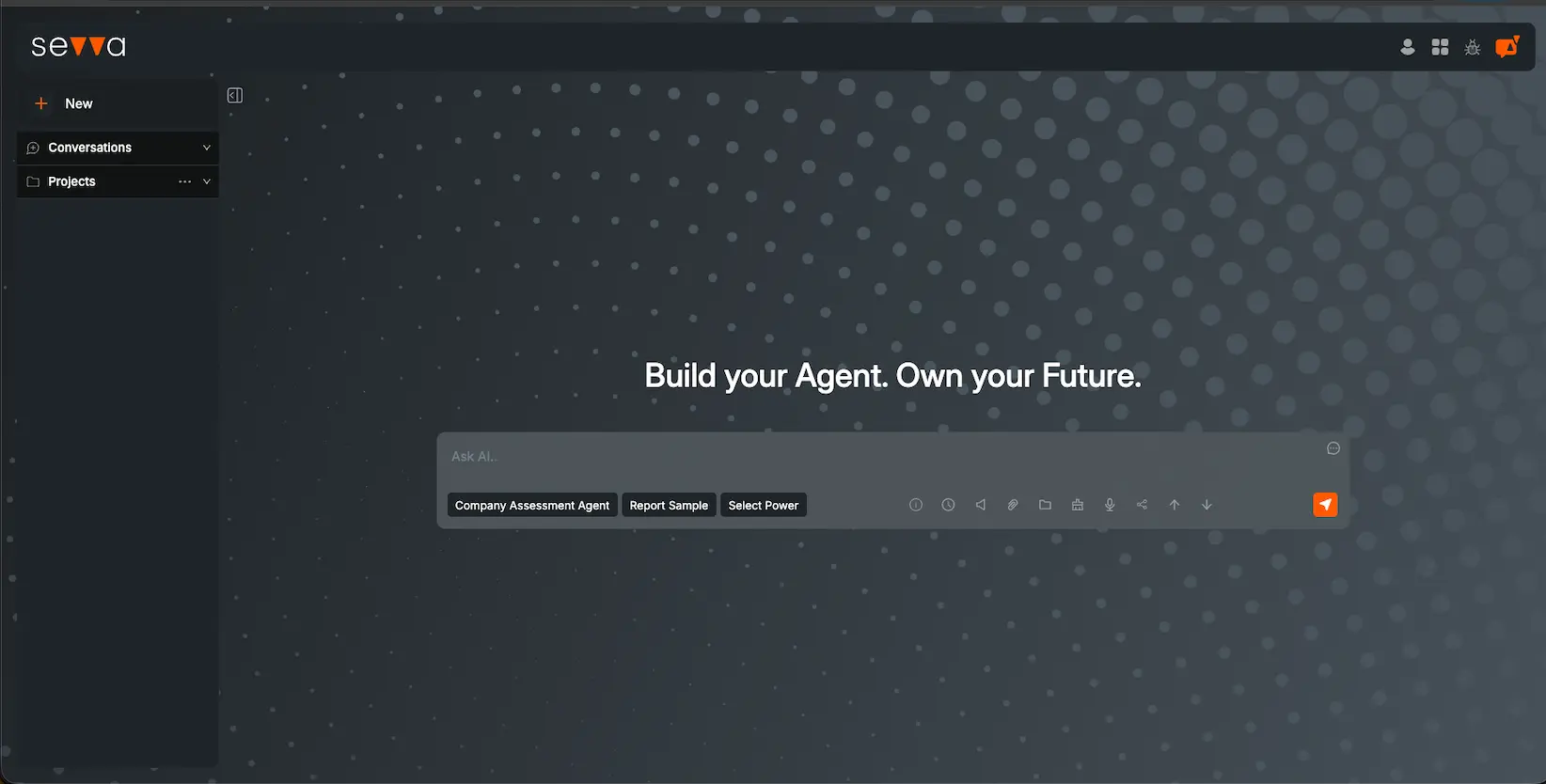

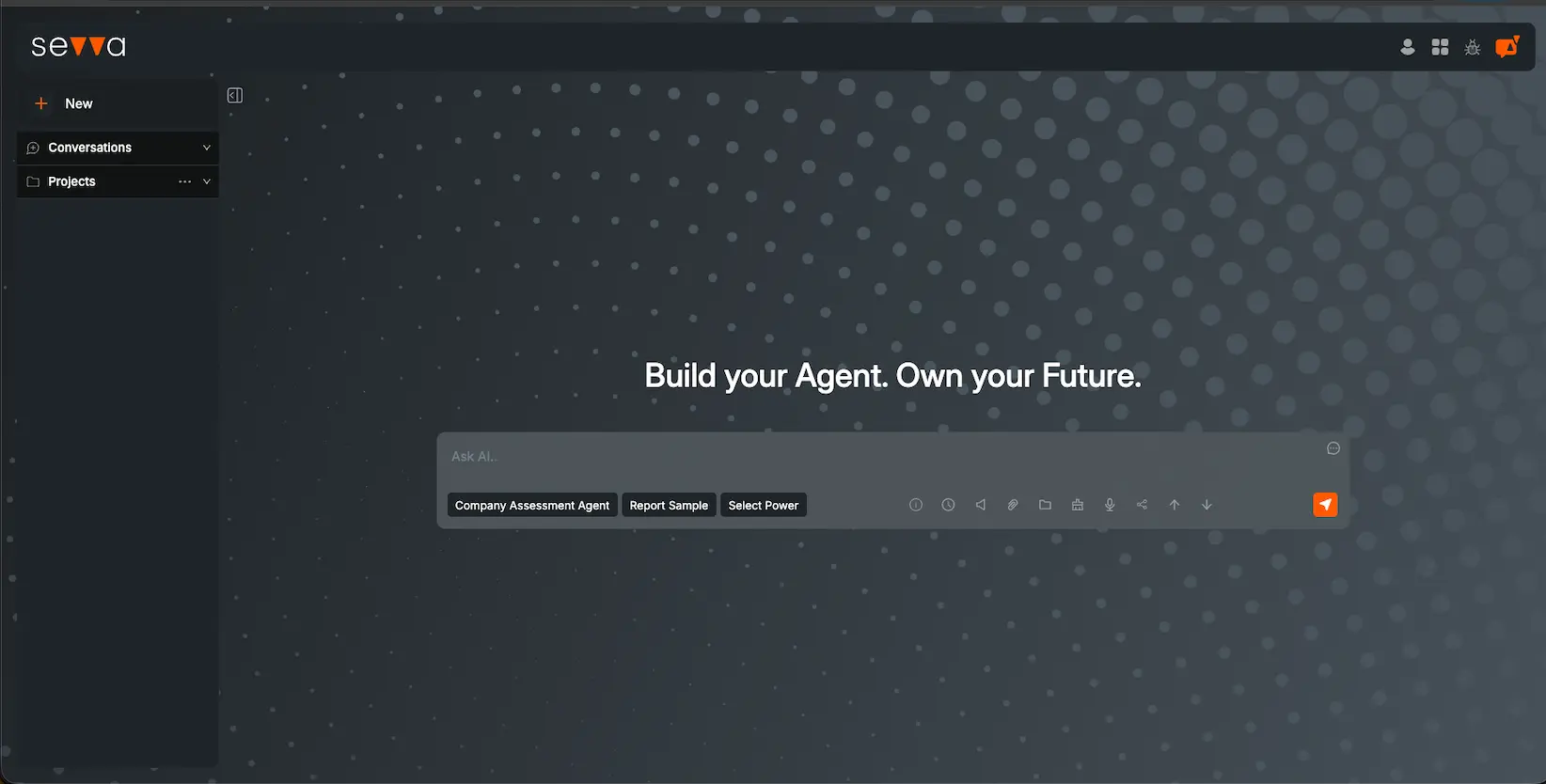

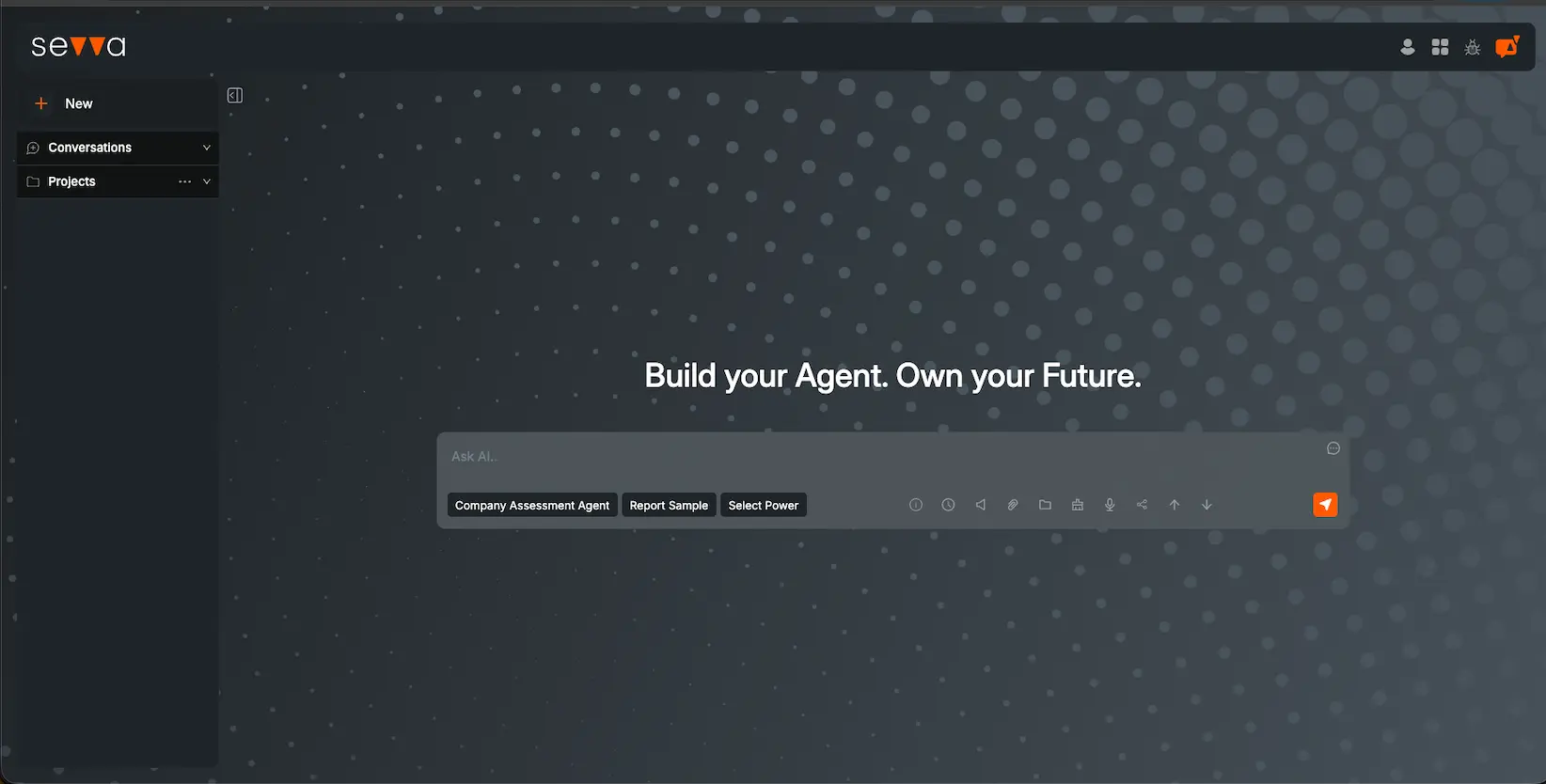

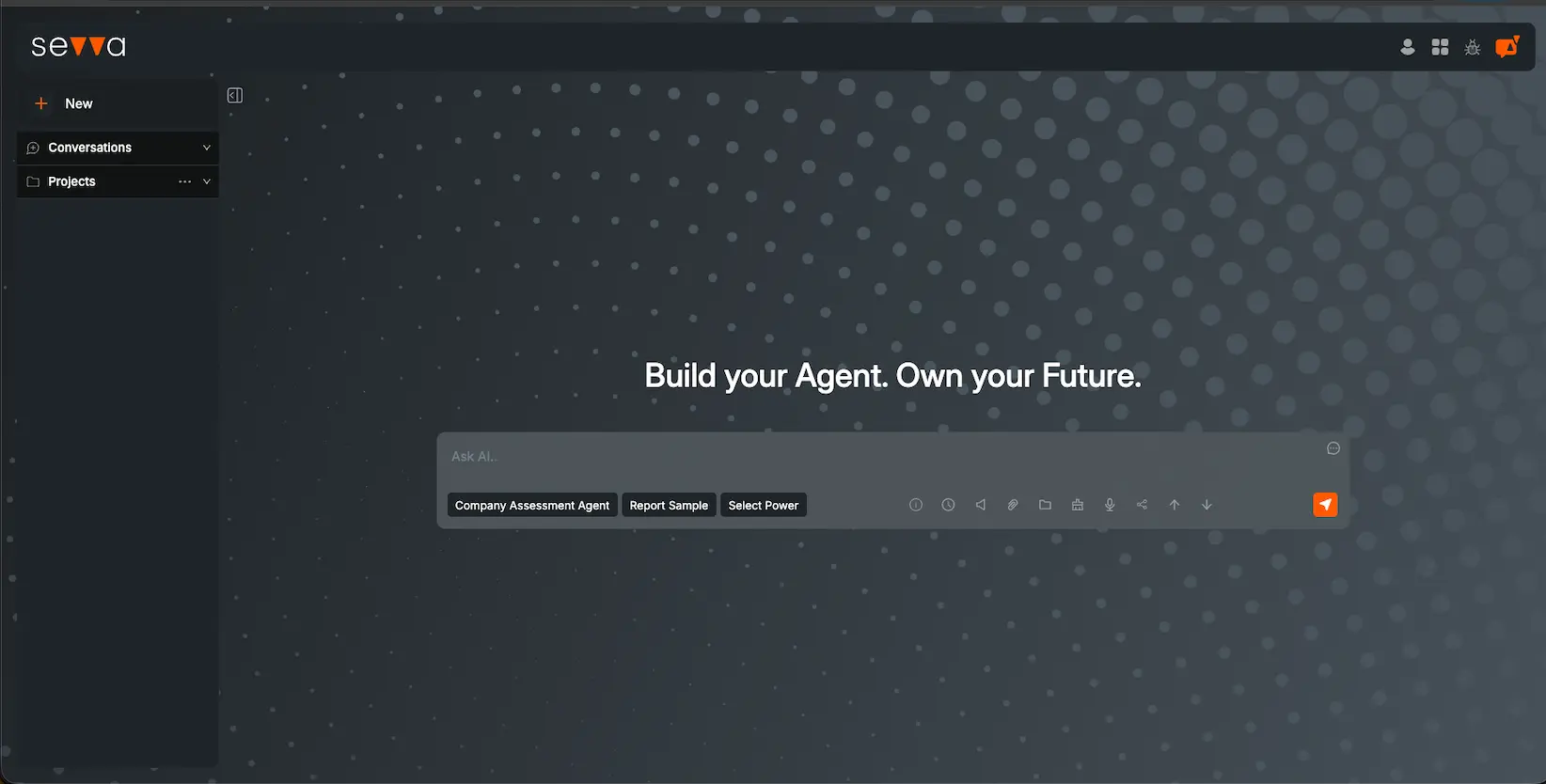

Sevva Workspace

Sevva WorkspaceWorkspace

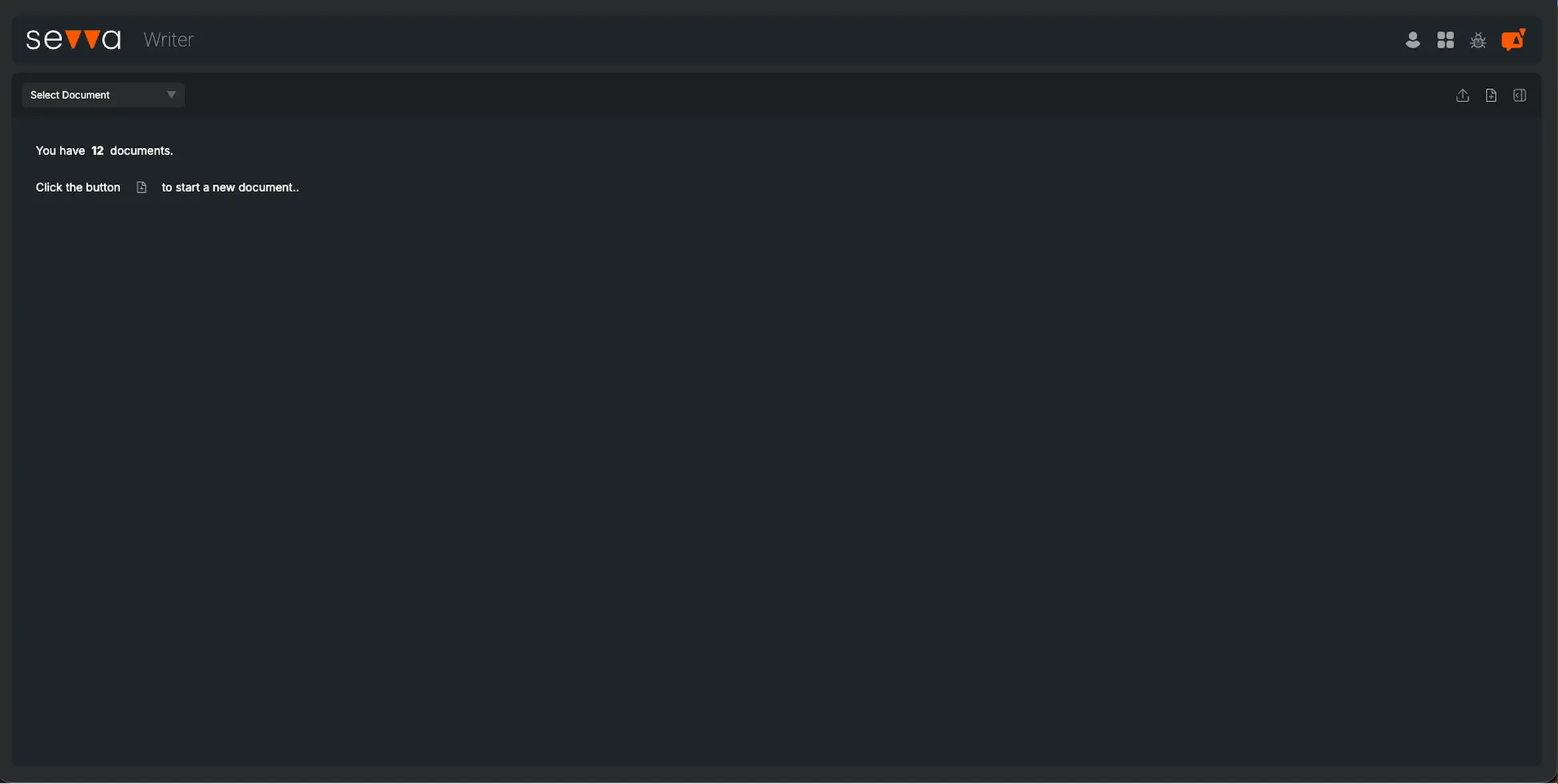

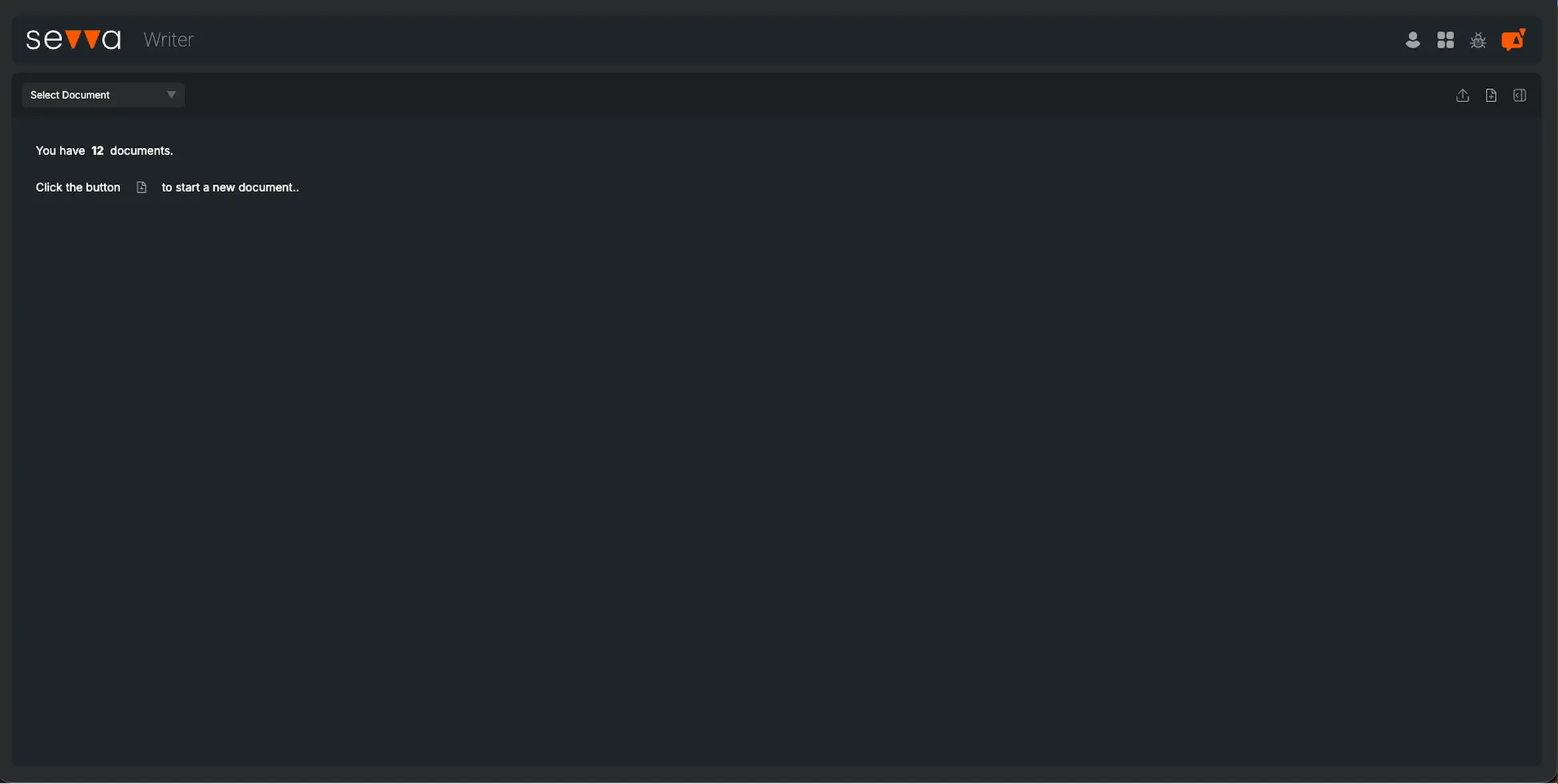

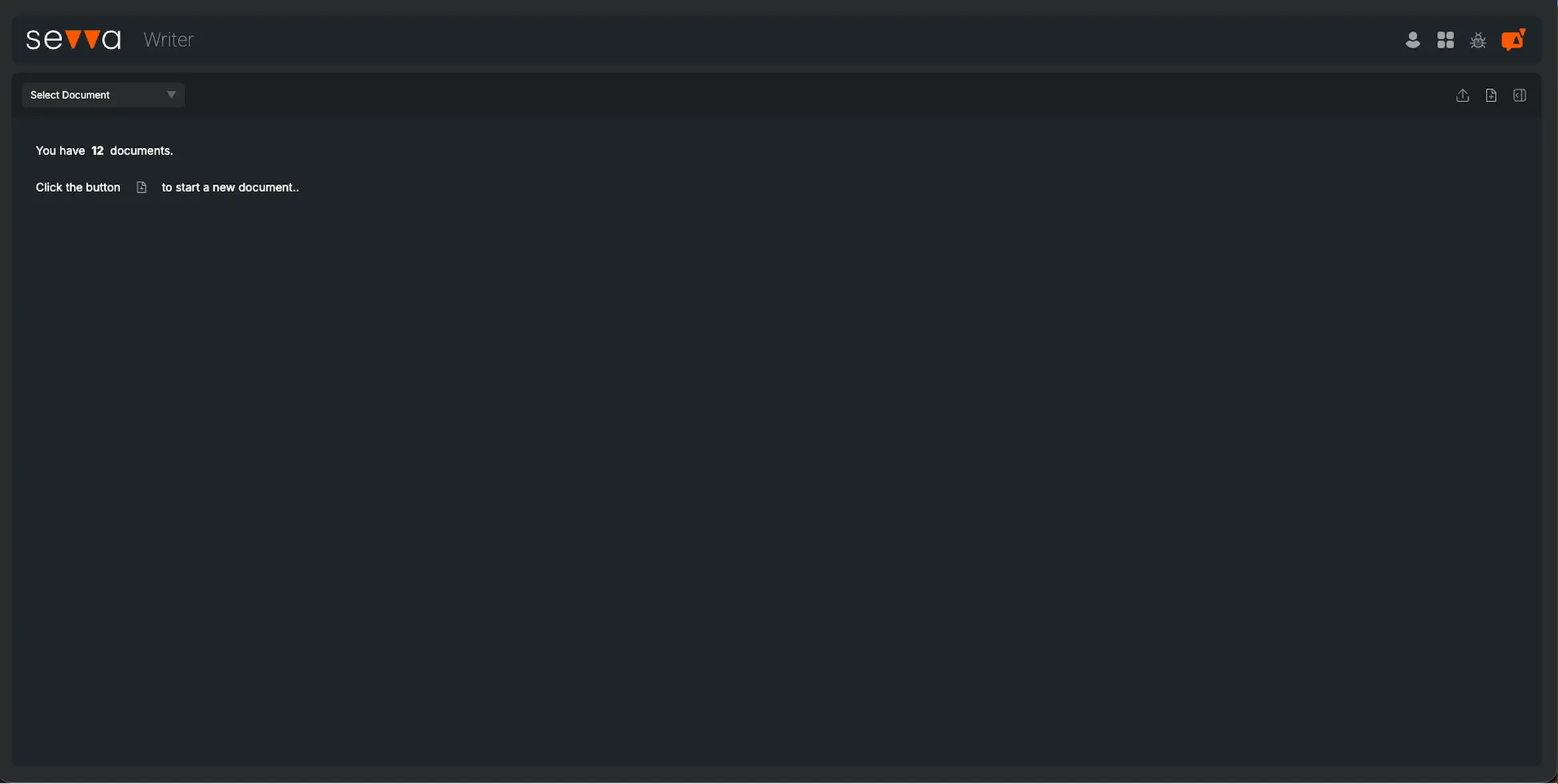

Sevva Writer

Sevva WriterPowerful AI Writer Tool

Sevva Reader

Sevva ReaderRead Your Data Smarter

Sevva Tabular

Sevva TabularA Better Tabular Viewer

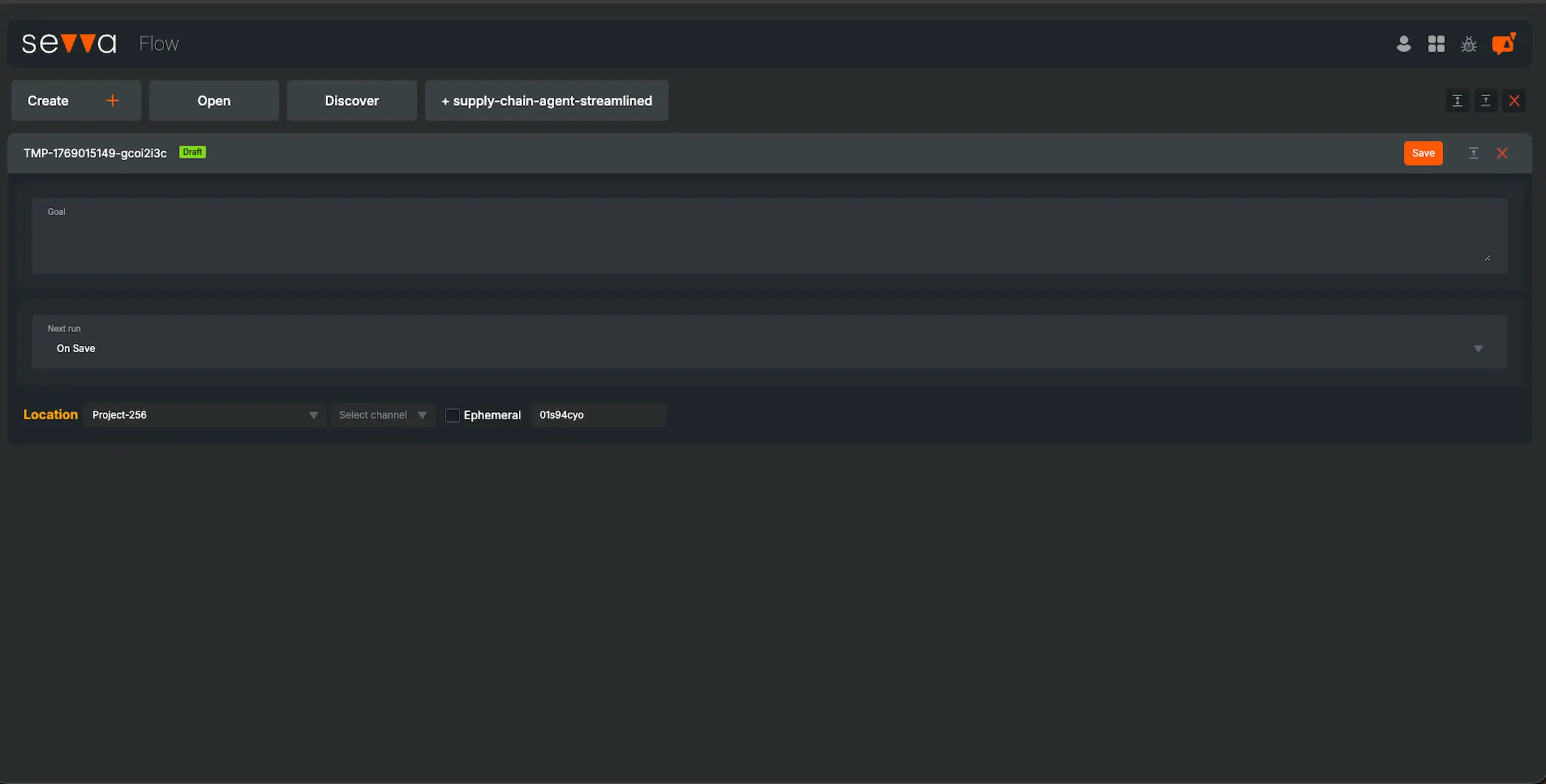

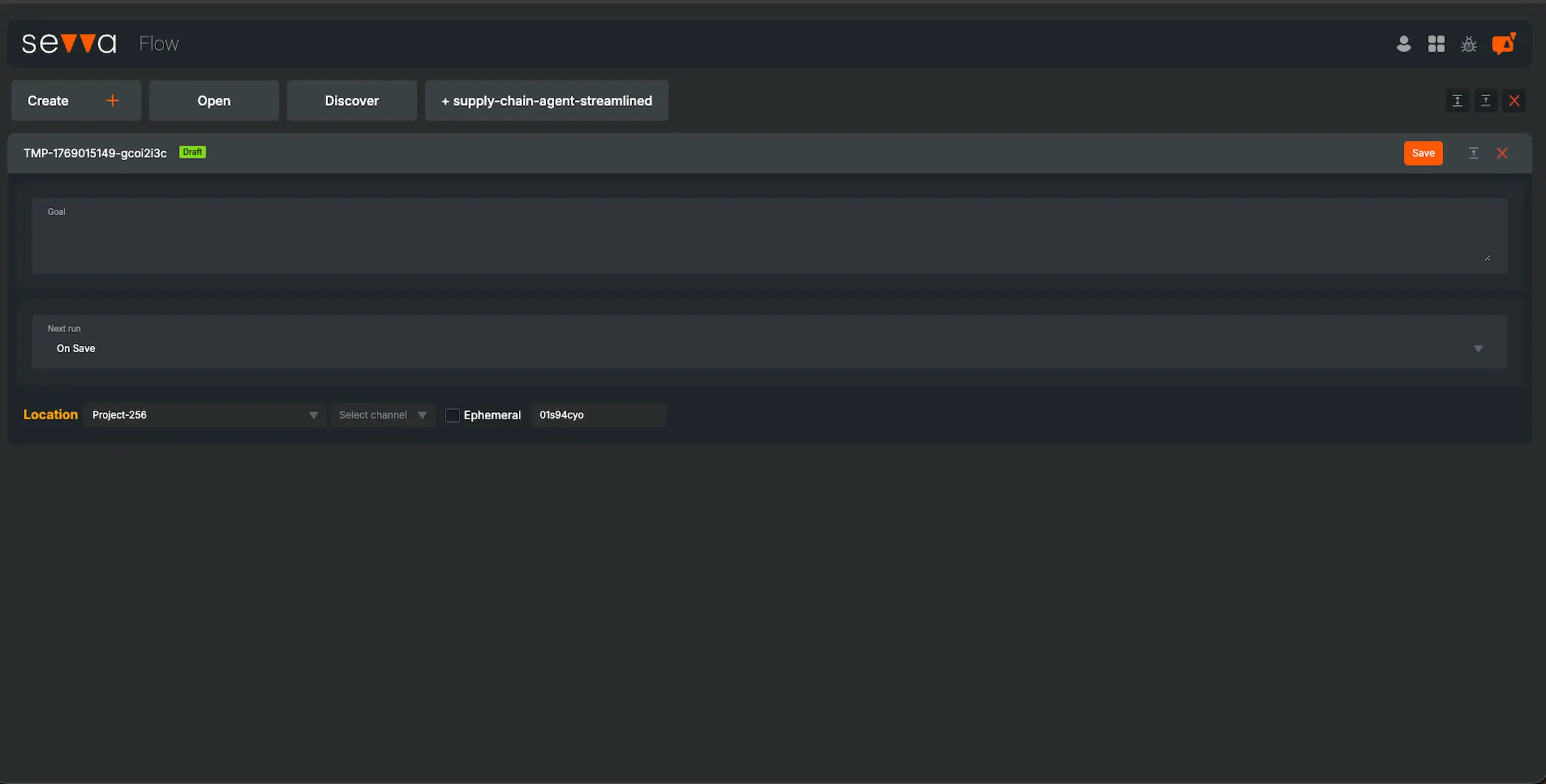

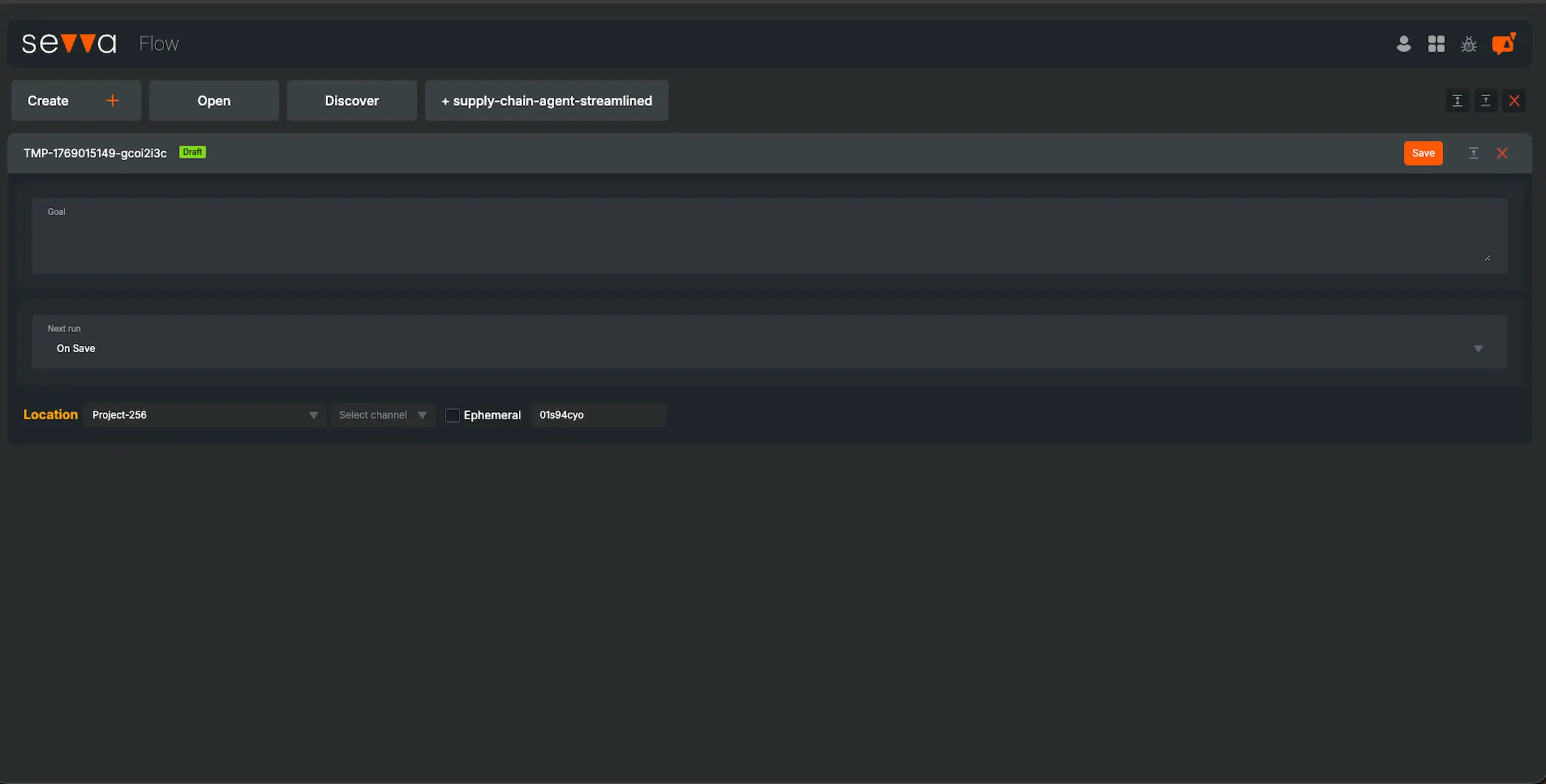

Sevva Flow

Sevva FlowA Powerful Flow Tool

AI Agent Hub

Sevva AI Agent HubSupercharge your business with State-of-the-Art Generative AIs. Instantly subscribe to Generative AIs now to empower your business.

Portfolio AI Solutions

Sevva Portfolio AI SolutionsSupercharge your business with State-of-the-Art Generative AIs. Instantly subscribe to Generative AIs now to empower your business.

News

NewsLatest news and blog posts.

Sevva Platform

Sevva PlatformAccess the Sevva Platform

Sevva Workspace

Sevva WorkspaceWorkspace

Sevva Writer

Sevva WriterPowerful AI Writer Tool

Sevva Reader

Sevva ReaderRead Your Data Smarter

Sevva Tabular

Sevva TabularA Better Tabular Viewer

Sevva Flow

Sevva FlowA Powerful Flow Tool